E-Invoicing on Extended Registration

E-invoicing is the digital exchange of invoices in standardized formats (such as XML or UBL), enabling automated processing by accounting systems. It eliminates manual work, reduces errors, and ensures faster, more compliant billing workflows.

![]()

Table of Contents:

What is E-Invoicing?

Setting Up E-Invoicing in Extended Registration

Verifying E-Invoicing in Invoicing Journal(s)

How Do You Confirm E-Invoicing?

Managing and Monitoring Your E-Invoices

What is E-Invoicing in Extended Registration?

Extended Registration offers full integration with the Peppol network.

Peppol (Pan-European Public Procurement Online) is an internationally recognized framework for exchanging e-invoices securely and efficiently. It’s designed to simplify cross-border invoicing while ensuring compliance with global and regional regulations.

Currently, e-invoicing is available for invoicing for companies based in:

- Belgium

- Netherlands

- Luxembourg

- Germany

- Sweden

- Ireland

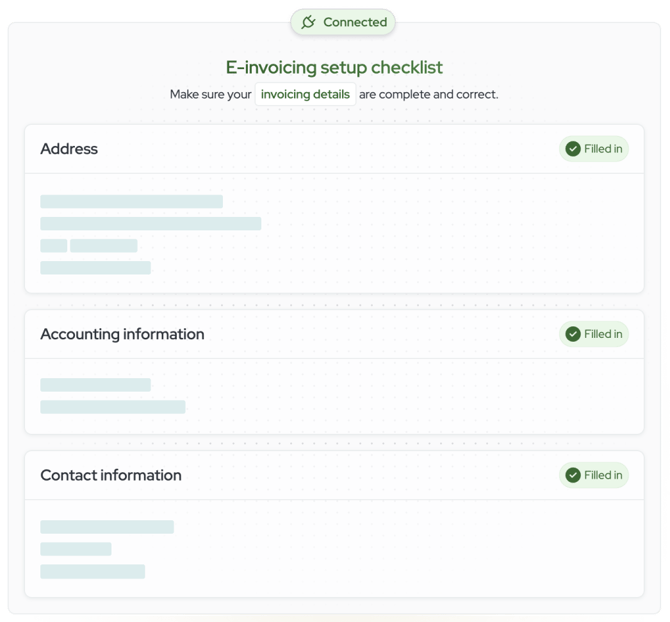

Setting Up E-Invoicing in Extended Registration

Getting started is simple. Follow these steps to connect your organization to the Peppol network and begin sending compliant e-invoices.

Go to Profile(s) > Company > Invoicing details

Enable the toggle “Use dedicated invoicing details” and complete the required fields:

- Address

Complete address and country of the invoicing entity - Accounting information

VAT number and bank account number are mandatory - Contact information

Website , Email, Phone

Once details are completed correctly, an option will appear to activate e-invoicing.

A preview window will display all the entered information — review and click “Save” to create your supplier profile on the Peppol network.

If everything is configured correctly, a green “Connected” icon will confirm that your organization is now Peppol-ready and able to send e-invoices.

Verify E-Invoicing in Invoicing Journal(s)

In the preview screen, follow the link to your Financial Journals list and confirm that e-invoicing is active.

- Green icon → E-invoicing is active

- Orange icon → VAT mismatch (typically between the journal and your Peppol profile)

Ensure the VAT number in the journal matches the one used during Peppol registration to fully activate e-invoicing.

Event Setup for E-Invoicing

To ensure your event is fully compatible with Extended Registration e‑invoicing system, make sure the following settings are correctly configured:

1. Set your event as a paid event

First and foremost, your event must be set as a paid event with ticket prices added. E‑invoicing only applies when actual invoices are generated from monetary transactions.

2. Link an invoice journalMake sure you’ve linked an invoice journal to your event.

Note: Receipts are not official financial documents and cannot be used for e‑invoicing.

3. Enable invoice generationTo trigger invoice creation automatically, activate one or both of the following checkboxes in your event settings (Money > Settings):

- Automatically generate invoice upon registration

- Generate and attach invoice to confirmation email

These ensure the invoice is generated at the correct moment in the user journey.

4. Mandatory standard fields in the event formTo allow e‑invoicing to work as expected, you must include the following mandatory standard fields in your registration form:

|

Field |

Description |

|

Company Name |

Legal name of the registrant’s organization |

|

Street Address |

Full address (required for compliance) |

|

ZIP/Postal Code |

Must be included with city and country |

|

City |

Required for billing location accuracy |

|

Country |

If the country selected is not one of the 6 supported countries (Belgium, Netherlands, Luxembourg, Germany, Sweden, or Ireland), e‑invoicing will not be sent. |

|

VAT Number* |

Enable VIES check for real-time validation |

If the registrant’s country is not supported, they will still receive a PDF invoice instead of a Peppol e-invoice.

* This adds an extra layer of control: the system will display a validation message indicating whether the entered VAT number is valid or not. Attendees can still register even if the VAT number isn’t valid — but you'll be aware of its status.

Tip: Add placeholder or explanatory text (e.g., “Format: BE0803941245”) to help attendees enter VAT numbers correctly.

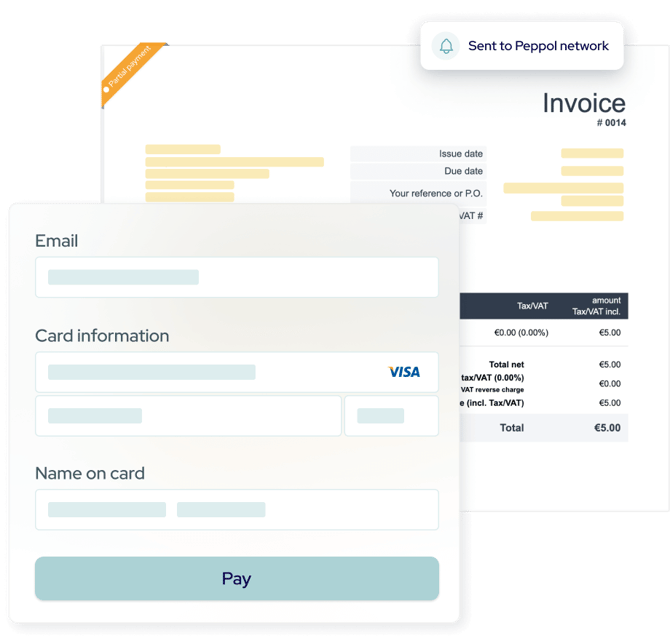

How Do You Confirm E-Invoicing?

- The registrant completes the form with their country and VAT number.

- If recognized on Peppol, they automatically receive the e-invoice.

- If not, they still receive the standard PDF invoice by email.

Either way, you’re covered!

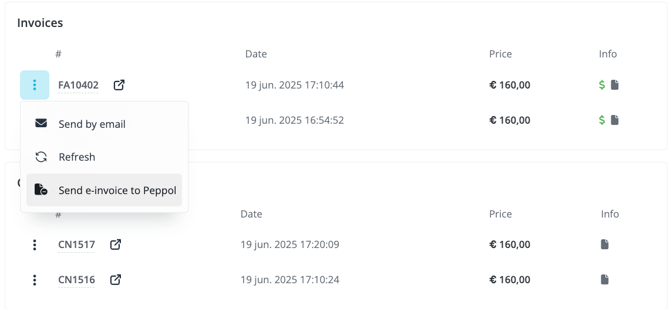

Managing and Monitoring E-Invoices

Once registrations start coming in and invoices are being generated, you can easily monitor e-invoicing activity directly within the attendee list of your event.

Each attendee’s record gives you clear visibility into:

- Whether an e-invoice was successfully sent via Peppol

- Whether only the PDF invoice was sent

- Any VAT validation or delivery issues

You can also:

- Manually re-send an e-invoice through the Peppol network

- View detailed logs in the attendee record (invoice history, status updates, system actions)

In the Invoicing module, under Invoices and Credit Notes you’ll immediately see whether an e-invoice was sent or not:

- No icon → No e-invoice sent via Peppol

- Green icon → E-invoice successfully sent

These built-in monitoring tools allow you to confidently manage financial compliance, reduce follow-up effort, and keep full control over your invoicing process.

Nothing changes to the existing invoicing features or workflows. All registrants will always receive the PDF version of their invoice by email. If the registrant qualifies for e-invoicing (e.g., their VAT number is registered on the Peppol network), an additional e-invoice is sent automatically. This ensures full coverage in every scenario.

Summary

These built-in tools let you:

- Maintain full visibility over e-invoice status

- Ensure compliance with EU e-invoicing standards

- Minimize manual follow-up and errors

- Streamline financial operations across borders